| To keep you updated, we send Daily Newsletter to your mailbox. In case, you wish to Unsubscribe Click Here |

Wednesday, July 22, 2020

You are more likely to contract Covid at home

Tuesday, July 21, 2020

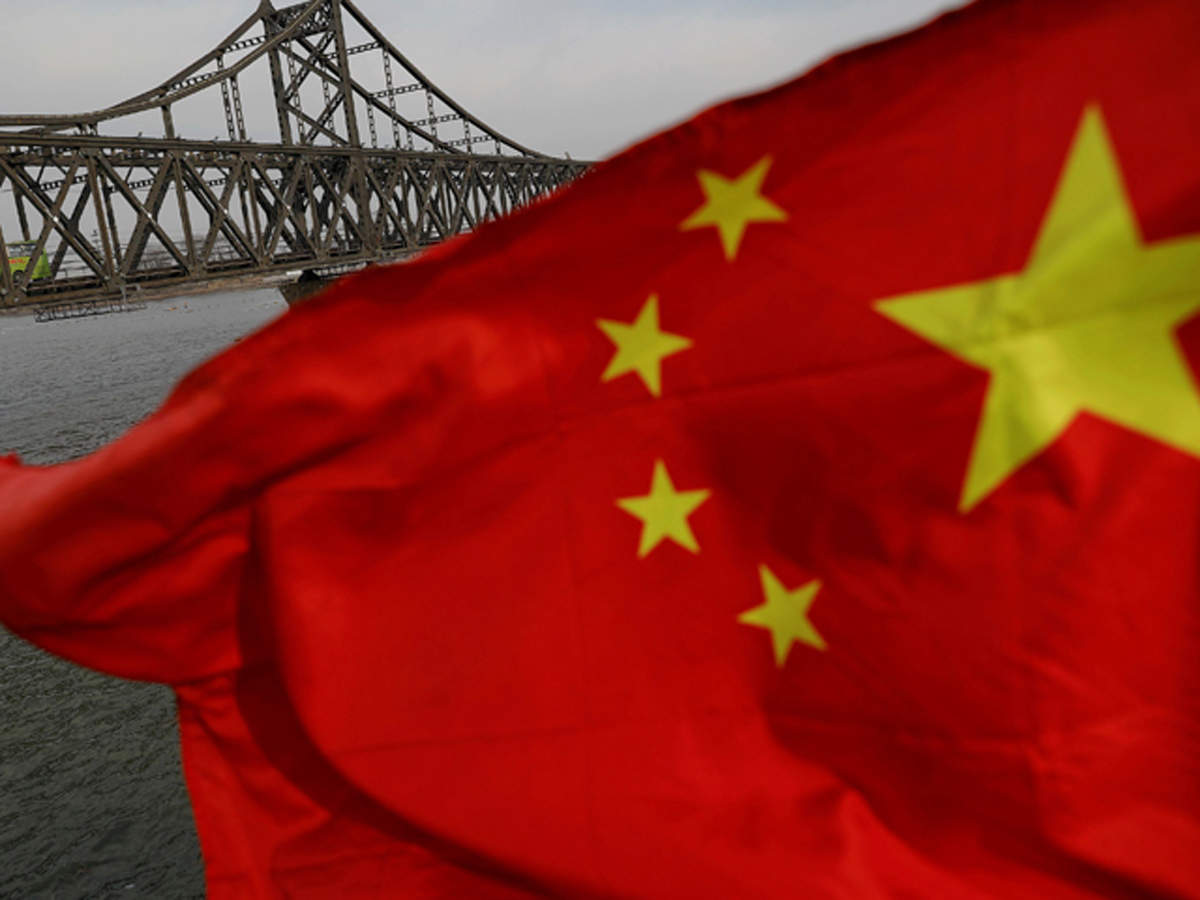

China's Lehman moment

| To keep you updated, we send Daily Newsletter to your mailbox. In case, you wish to Unsubscribe Click Here |

Subscribe to:

Comments (Atom)

|

|